The case for grassroot minimal trust fiatcoins as basis for trustless fiatcoins

Consideration and LN / Taro / RGB feature requests

[update 27/10/2022: replaced stablecoin by fiatcoin, to recognise that fiatcoins don’t have stable purchasing power]

LN, the Lightning Network, provides for a breakthrough in permissionless, trustless, decentralised transfer of satoshi balances - that for many have value - with quasi free (about 100ppm) and quasi instant (seconds) settlement.

The LNP/BP Standards Association announced the v0.8 RGB release of the RGB protocol on July 12, 2022 - Lightning Labs announced the alpha release of the first Taro daemon - which is inspired by RGB - on September 28, 2022 .

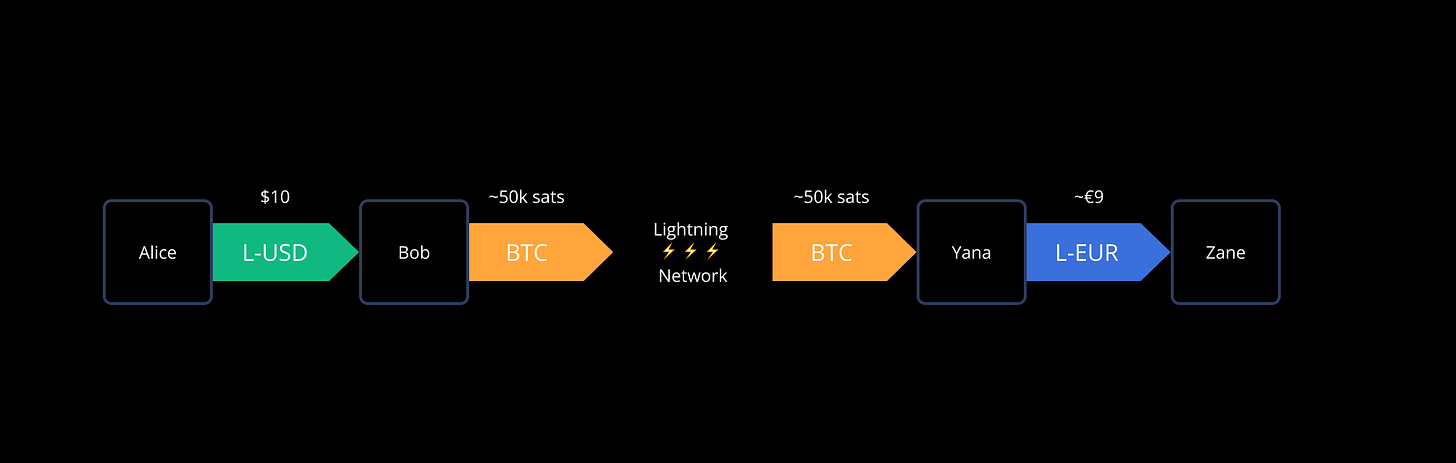

RGB or Taro on Lightning will enable fungible (e.g. L-USD and L-EUR) and unfungible tokens or assets other than satoshis to travel over the LN. This post is not about explaining RGB or Taro - please read the link above or below the below graph.

RGB and Taro enable nodes to issue an asset (e.g. L-USD or L-EUR) and establish a channel to another node to exchange the asset. An interesting property of Taro is that it enables these assets to travel over intermediate nodes that are unaware about the defined asset - at an agreed “exchange rate” - for example denominated in btc terms as in the below graph or in this video. The source of the exchange rate can be defined for each asset at the time of creation - and the asset as well as exchange rate can be shared through a “Universe”.

Many people are interested about fiatcoins - based on lower short term volatility. Today, USDT, USDC and other fiatcoins require trust - and therefore some argue oversight - that their issuers e.g. Tether or Circle hold USD or other assets to back the fiatcoin.

This post explores two avenues for fiatcoins to emerge - and explores how trust [update November 1, 2022 - “very minimual trust” - see explanation below] based fiatcoins can implicitly evolve towards trustless fiatcoins.

[update November 1, 2022 - it turns out reality has overtaken the below consideration that “trusted” non-collateralised or collateralised outside of the bitcoin network fiatcoins are necessary - it turns out that perpetual bitcoin-fiatcoin swaps are the solution to trustless fiatcoins - the only remaining trust required is the trust in the organiser of the swaps. A first implementation of that solution is the Galoy solution referred in the Derivatives backed fiatcoins chapter in the Trustless quasi fiatcoins consideration. The Bitcoin Beach Wallet now enables USD fiatcoin in app and works really seamlessly, based on Stablesats - no need to look for alternatives - the brand should have been fiatsats rather than Stablesats, but that is a detail. The only thing developers should pursue is reducing counterparty risk - this can easily be achieved by diversifying the # of counterparties - all exchanges could / should offer perpetual swaps (as they sell BTC for USD or other fiat. In the same way as Galoy implemented their fiatcoin solution, banks or individuals can also establish perpetual swaps to enable trustless fiatcoins - developers can evaluate if RGB or Taro can help implementing this. ]

Banks issue Taro or RGB fiatcoins

Many people trust their bank. With Taro or RGB, it is easy for banks to issue “bank branded” fiatcoins, e.g. “DB-EUR” or “LB-USD” (pun intended). As the assets definitions include appropriate exchange rates between “DB-EUR” and “ING-EUR” (in that case 1 equals 1), Taro or RGB would effectively enable compatible fiatcoins, issued by multiple banks, and as a result make central bank digital currency irrelevant. All it takes is sufficient people who have both a channel with DB and ING in this example - these people can relay payments between the bank - as well as the banks can establish a large channel between themselves to ensure "compatibility”.

Banks have a choice: do they issue their own fiatcoin on Taro or RGB and keep control (albeit very limited control) - or do they wait for central banks to disintermediate banks. People have the opportunity to build a fiatcoin with far superior properties than any Central Bank Digital Currency - CBDC - can achieve.

Taking game theory into account, one can argue banks don’t have a choice. Banks operate in a competitive landscape. Every bank has an interest to be the first bank to provide its customers with the optimal services - any bank that fails to do so, will over time lose market share to other banks or new financial service providers - or to individuals as below.

Friends issue Taro or RGB fiatcoins

Do you trust your friends? Similarly as banks, individuals could also issue fiatcoins, e.g. “Alice-EUR” and “Bob-EUR” - and establish channels with trusted friends. Again it would be sufficient to establish appropriate exchange rates between the fiatcoins of two different friends to make the fiatcoins fungible. When multiple people establish their “own” fiatcoin channels with respective trusted parties, implicitly “trustless” fiatcoins emerge - as one can rely on fiatcoins issued by unknown parties to the sender or receiver - defined by intermediate parties with a compatible exchange rate. People have the opportunity to build a fiatcoin with far superior properties than any Central Bank Digital Currency - CBDC - can achieve.

That’s it.

This process turns grassroot (or bank issued) trusted [update November 1, 2022 - “very minimual trust” - see explanation above] fiatcoins into trustless fiatcoins - limiting counterparty risk to the trust we have in trusted parties, such as certain friends or certain banks. Who do you trust more to pay back your fiatcoin [update November 1, 2022 - IOU?] swap? Your friend, your bank or the state?

What is required to enable these processes:

Nodes need to be able to establish exchange rates (already envisioned)

Nodes need to be able to define “equivalent” assets - e.g. Alice-EUR = Bob-EUR

Reliable redundant exchange rate sources / Universes need to exist - nodes need solid logic to test if exchange rate information is reliable - for example maximum deviation versus previous period, … to avoid funds being drawn at a fraudulent exchange rate - and as result value loss

The ability to define an “interest rate” for unbalanced channels - enabling automatic charging of mutually agreed interest between trusted parties if one party “borrows” from the other - holds excess funds on their side of the channel.

Ulteriorly, this could substitute conventional lending altogether - that is a topic for a future consideration

The developer community is no doubt already working on these feature requests.

Further considerations:

Grassroot trusted fiatcoins have the unique ability to enable individuals to “create” money - which was previously the privilege for banks. Indeed, anyone can issue an asset - effectively an IOU or you ow me - towards a set of trusted parties, only based on the trust that the channel balance will be appropriately paid back (e.g. in cash or by wire / IBAN) in case any of the trusted parties wants to close the channel.

Grassroot trusted fiatcoins can disrupt lending - especially relevant in emerging markets - as they enable establishing a unbalance towards a trusted party, which in turn can provide an unbalance towards a third party, effectively lending your funds to untrusted parties - with your direct connection remaining liable to pay back the loan. This consideration is subject for ulterior philosophical reflection and operational feasibility study.

Grassroot trusted fiatcoins include potential for distributed AML/KYC: if we trust in the average moral attitude is equal or better than the “state” morality, we can trust that people would only establish channels with trustworthy parties - i.e. we can expect people to avoid establishing channels with terrorists. This consideration is subject for ulterior philosophical reflection by lawmakers and other interested parties.